It seems our modern news cycle boils down to an endless loop of excruciating situational irony. Perhaps no situation better exemplifies this than the collapse of Silicon Valley Bank and the subsequent newfound socialism of Silicon Valley executives.

Silicon Valley types are self starters. They have, regardless of your opinions of them, captured a generation with stories of winning unbelievable fortunes from what was relegated to fantasy less than half a century ago. Many of the most well known Silicon Valley stories have been etched into the American Capitalist Gospel: Bill Gates’ invention of Windows OS in his garage, Jeff Bezos’ creation of Amazon as a modest bookstore, and Mark Zuckerberg’s designing of Facebook as a creepy Harvard undergrad.

In many respects, they have become the modern Robber Barons of a second gilded age: marked by emerging industry, dramatic changes in lifestyle, and utterly jaw dropping economic inequality. There are certain loyalties they have had to adopt as princelings of American Profit, though. One of these is an undying devotion to capitalist values: respecting the sanctity of the free market at all costs, and embracing the good, the bad, and the ugly that go along with low regulation and high competition.

Sure, many Silicon Valley executives are liberal on social issues, but they take a markedly different stance when it comes to business. Studies of this new elite class’ economic philosophies suggest that they are staunchly and shamelessly in favor of deregulating the financial sector. They have continually worked to influence politicians to pursue deregulation in a myriad of forms. The most pertinent to our case? SVB executives helping to push for changes to the Dodd-Frank Act that would disqualify their bank from further regulation.

Often, this opposition to further regulation manifests as a “libertarian persuasion.” Many executives have framed their philosophies not as shameless structures engineered to maximize their profits, but rather as earnest attempts to retain true American competition and foster further innovation. If their firms are so heavily regulated, how will they be able to innovate at the same breakneck pace that has characterized the tech revolution of the last twenty years?

There are no inherent moral qualms to holding a libertarian point of view: it is among one of the most celebrated values of American Society. The problem lies in how this point of view shatters under duress.

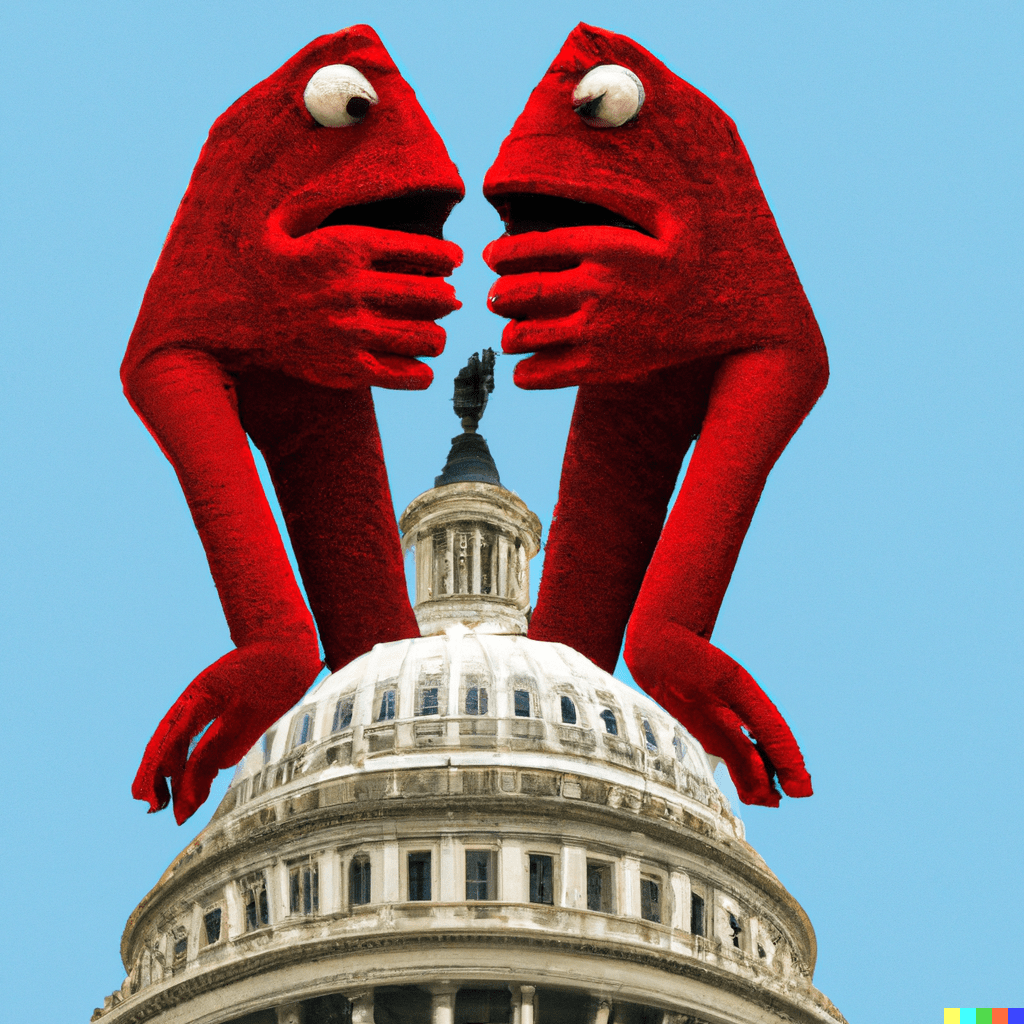

The day Silicon Valley Bank collapsed, something absolutely remarkable happened. It seemed that all semi-twitter famous Silicon Valley executives all agreed to become socialist within just a couple hours of each other. Below are some of their statements:

Jargon and pragmatic tones aside, there is no shielding what these executives are so desperately seeking. They want money, from the government, to protect their investments. On a dime, unapologetically staunch libertarians began to beg for a bailout necessitated, in the opinions of some, entirely by their own actions.

Perhaps even more frustrating to read than their tweets is the Government’s response to their alligator tears. Shortly after the collapse of SVB, a bank notorious for serving some of the wealthiest executives and firms in Silicon Valley, the U.S Government announced that all depositors would be made whole. Although the technical “maximum” FDIC insured limit is $250,000, accounts with tens and hundreds of millions of dollars would receive all of their money back as soon as the government could get it to them, with no strings attached, and no known consequences for SVB executives.

Perhaps even richer is the timing of the bailout: this multi-billion dollar safety net is being deployed with reckless abandon as the very constitutionality of Biden’s student loan debt forgiveness plan has been questioned by courts, in cases filed by activist interest groups who were against the policy. The money meant to go to debtors across the country has been held up, and its fate is now in question. Shockingly, there has been no challenge to the constitutionality of the SVB Bailout, likely because the culture that underlies that one is woven into the very fabric of our country.

There isn’t really a term for it, other than breathtaking, almost hilarious situational irony. It is corporate hackery at its very finest: the latest class of “the greatest minds in American Business” who are, for some unexplained reason, allowed to make catastrophic mistakes with total impunity. It is a second set of rules: the lax suggestions for those at the top, in which a bad financial decision means a 200 character request on Twitter that yields hundreds of billions. We have engineered a society in which everyone is subservient to a couple people who had good ideas mixed with a lot of luck, and now get to sit in the driver’s seat of our economy and government.

SVB makes a catastrophic, potentially globally destabilizing mistake, and gets a bailout. I go to college, and get tens of thousands in debt to deal with all on my own. They’re both choices: it’s just that one was made by a bank, and the other made by a regular guy.

How do they always get away with it.